Inheriting Property in the Philippines: A Simple Guide Everyone Should Read Before It’s Too Late

Inheriting Property in the Philippines: A Simple Guide Everyone Should Read Before It’s Too Late

(Who this is for)

If you’re:

- A Filipino inheriting property

- A former Filipino citizen

- A foreigner with Filipino family

- Or someone who knows they will inherit property someday

This guide is for you.

Why inheritance causes so many problems in the Philippines

In the Philippines, millions of properties are inherited but never properly transferred.

Families assume:

- “Automatic na yan”

- “Kami na bahala later”

- “Wala namang nagmamadali”

Years later:

- Titles are still in a dead person’s name

- Taxes balloon because of penalties

- Siblings are fighting

- Properties can’t be sold

Inheritance isn’t emotional — it’s administrative. And if you don’t do it properly, it becomes expensive.

What “inheriting property” really means (in plain English)

When someone dies, their property freezes legally.

You don’t truly own it until you:

- Identify the legal heirs

- Pay estate taxes

- Transfer the title to the heirs

Until then:

- You cannot sell it

- You cannot mortgage it

- You don’t fully control it

Two ways inheritance happens

1. With a Will (Testate Succession)

The deceased left written instructions.

✔ Clearer distribution

✔ Faster process

✘ Still must follow Philippine inheritance laws

⚠ Note: Even with a will, you must follow Philippine “Compulsory Heir” laws. You cannot legally “disinherit” a spouse or child without very specific, extreme legal grounds.

2. Without a Will (Intestate Succession)

The law (the Civil Code) decides.

Typical order: Children → Spouse → Parents → Siblings.

If there are multiple heirs: Everyone becomes a co-owner. No single heir can sell the entire property without the consent of the others. This is where most family disputes start.

Who can inherit property in the Philippines?

Filipino Citizens

✔ Can inherit any property

✔ Can keep, sell, or transfer freely

Former Filipino Citizens

✔ Can inherit property, but Land Ownership Limits apply:

Residential: Up to 1,000 sqm (urban) or 1 hectare (rural).

Commercial: Up to 5,000 sqm (urban) or 3 hectares (rural).

Note: If you inherit more than this via a Will, you may be required to sell the excess.

Foreigners

✔ Can inherit

❌ Cannot permanently own land

They may:

- Inherit temporarily

- Sell the land

- Receive cash proceeds

- Own condo units (subject to 60% Filipino rule)

Important: Using a Filipino name “in trust” is illegal.

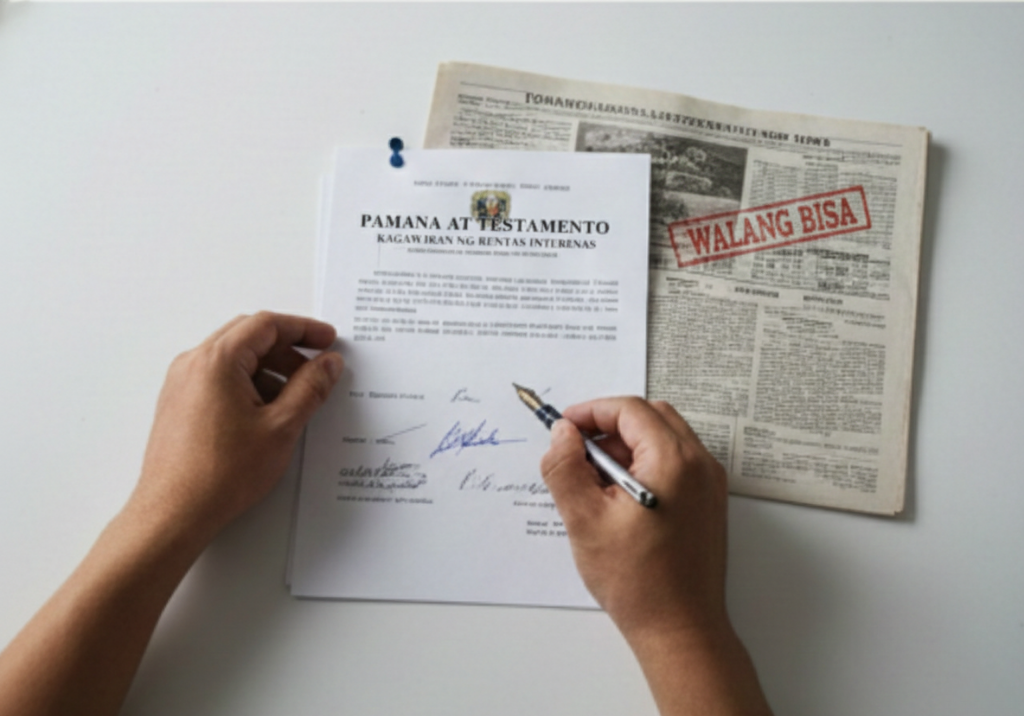

The taxes that surprise everyone

Estate Tax

Rate: A flat 6% of the net estate value (under the TRAIN Law).

Deadline: Must be filed and paid within 1 year from the date of death.

Penalties: Missing the deadline adds a 25% surcharge + 12% interest per year.

💡 Pro Tip: Check if there is a current Estate Tax Amnesty program. The Philippine government occasionally passes laws that allow heirs to pay the 6% tax while waiving all penalties and interests for older cases.

Step-by-step: How inheritance actually works

Step 1: Gather documents

Death Certificate (PSA Authenticated)

Original Owner’s Duplicate Title

Updated Tax Declaration

Voters ID/Passport of heirs

Step 2: Settle who gets what

- With will → follow it

- Without will → Extra-Judicial Settlement

Requirement: The EJS must be published in a newspaper once a week for three consecutive weeks. This is a legal requirement to notify any unknown creditors.

Step 3: Pay estate tax

- File with BIR

- Pay 6% Estate Tax

- Secure Certificate Authorizing Registration (CAR). Without this document, the title cannot be moved.

Step 4: Transfer the title

Pay the Transfer Tax at the Treasurer’s Office.

Register the documents at the Registry of Deeds.

A new Title is issued in the names of the heirs.

Only after this can the property be sold or transferred.

The most common (and costly) mistakes

❌ Not transferring the title for years

❌ Ignoring estate tax deadlines

❌ Assuming one heir can sell alone

❌ Forgetting land limits for foreigners/former Filipinos

The one rule everyone should remember

No estate tax paid = no real ownership

Why this matters even if you’re “not there yet”

You don’t need to be inheriting property now for this to matter.

Knowing this:

Helps you plan: Talk to your parents/family about making a list of titles and properties.

Prevents conflict: Clear processes stop siblings from guessing who gets what.

Saves Money: Prompt action prevents tens of thousands in penalties.

Inheritance problems are easier to prevent than to fix.

Final thought

Property inheritance in the Philippines isn’t about being rich —

it’s about being prepared. If your family owns property, this process is inevitable. Start gathering the documents now before it’s too late.

Need help navigating a property transfer? Whether you’re dealing with an old title or need help calculating estate taxes, we are here to help.

- Inheriting Property in the Philippines: A Simple Guide Everyone Should Read Before It’s Too Late

Other Blog Articles